The escalating U.S.-China trade war is taking its toll on U.S. lobster exports.

Growing middle-class demand for live U.S. lobster in China boosted U.S. exports in the years before China imposed a 25 percent tariff in July 2018. The resulting price increase for Chinese buyers had immediate effects that deepened leading into 2019.

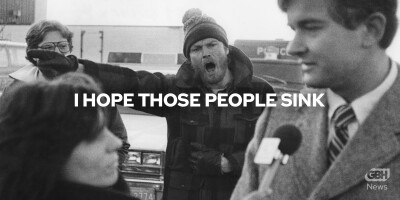

The burden of tariffs was high on radar at the annual Lobstermen’s Town Meeting of Maine and Canadian fishermen, dealers and processors in early April, because the cross-border industry is so tightly linked; Maine harvests 80 percent of U.S. lobsters and Nova Scotia holds that position among Canadian provinces.

Already U.S. live lobster exports to China of around 11.14 million pounds during January to June 2018 plummeted to just over 2 million pounds in the same first six months of 2019, according to NMFS foreign trade statistics.

Meanwhile, Canadian lobster dealers, unfettered by any new tariff pressure, are continuing to grow their China trade.

“We are seeing strong demand from China, but that is nothing new given the year over year growth in the last nine years,” said Geoff Irvine, executive director of the Lobster Council of Canada.

“Since the tariffs were implements last July we have seen our exports of frozen and live rise dramatically…which can be attributed to both a continuing fast growing market and the impact of the tariffs on U.S. sales.”

The Canada-China export sales figures are more than double in value from January to June 2018, when they totaled $111.8 million Canadian, to $265.6 million in the first six months of 2019, according to the council.

There could be an emerging threat for Canadian lobstermen and dealers who sell across the Atlantic. British Prime Minister Boris Johnson’s promise to take the United Kingdom out of the European Union by Oct. 31 could bring disruption to the markets in the U.K. and EU nations.

Johnson’s moves this week to block Parliament from meeting to debate Brexit could bring on a renewed political crisis and economic disruption before U.K. “crashes out” of the union without new trade arrangements.

The lobster industry’s travails mirror what’s been happening in the U.S. agricultural sector. U.S. farm exports to China exceeded $24 billion in 2014, fell to $9.1 billion in 2018, and declined by another $1.3 billion in the first half of 2019, according to an Aug. 5 report by the American Farm Bureau Federation.

“In the last 18 months alone, farm and ranch families have dealt with plunging commodity prices, awful weather and tariffs higher than we have seen in decades,” federation president Zippy Duvall said in a statement that announced the findings, and urged the Trump administration to press on with negotiating a trade deal with China.

“Farm Bureau economists tell us exports to China were down by $1.3 billion during the first half of the year. Now, we stand to lose all of what was a $9.1 billion market in 2018, which was down sharply from the $19.5 billion U.S. farmers exported to China in 2017.”

“Canada’s share of total Chinese imports of wheat has rocketed above 60 percent in (marketing year) 2018/19, up from 32 percent in 2017/18, as U.S. wheat exports to China have plunged and Australian exportable supplies have fallen sharply,” according to the report.