Amid the past year’s unstable foodservice and retail landscape, seafood has become one of grocery’s strongest players, catalyzing strong overall category growth by offering solutions to some of shoppers’ top priorities, such as health and wellness, ease of preparation, and quality.

This interest is translating into seafood sales, according to the 2021 Food Marketing Institute Power of Seafood Report, which includes year-over-year seafood sales by department sourced by NielsenIQ. Frozen seafood sales grew an astounding 36 percent, fresh seafood sales grew 25 percent, and grocery seafood grew 21 percent! According to the report, the seafood department was a leader in the growth of grocery sales with an overall increase of nearly 30 percent, much stronger than meat (18 percent), produce (11 percent), deli (0.3 percent) and bakery (-2 percent).

One of the hallmarks of the Alaska Seafood Marketing Institute’s retail and foodservice marketing program is our focus on operator education. Our goal is to increase the value and awareness of seafood from Alaska, and one of the best tools to achieve this is to let operators know what consumers want, through consumer research. Partnering with the largest strategic food-focused research firm, Datassential, we gather details on seafood consumption habits and preferences of both general and affluent (ages 25-74, college educated with a household income of $100K+) consumers to determine what motivates them to increase or maintain their at-home consumption, and seek to understand how the power of Alaska’s brand motivates purchase.

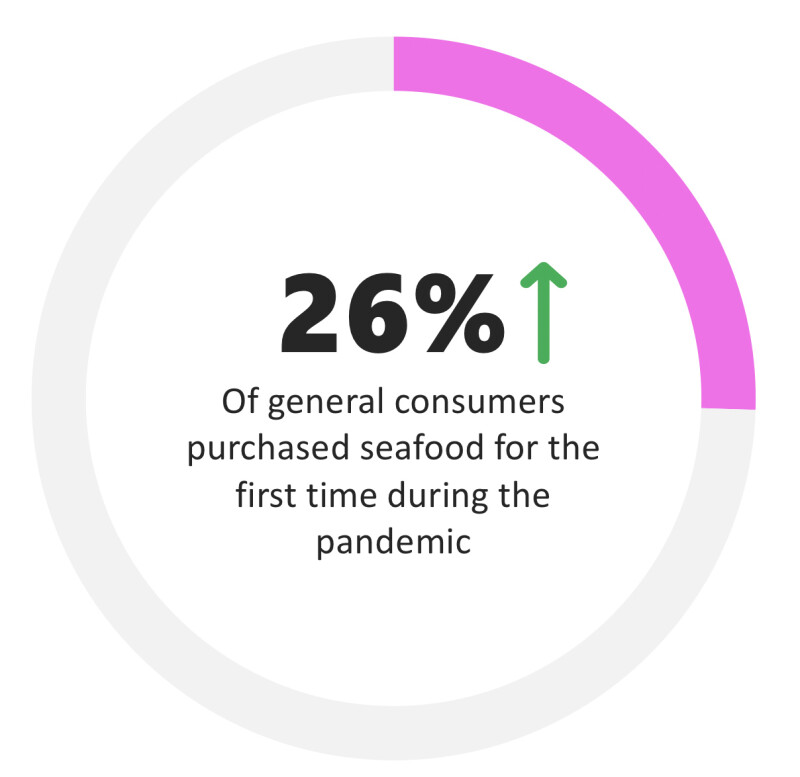

The recently completed research from Datassential in March 2021 provides valuable insights into the new consumer landscape. One of the most surprising facts was that more than a quarter of general consumers purchased seafood to eat at home for the first time ever during the pandemic. Meat shortages, increased emphasis on cooking at home, and a desire for new options may have prompted more consumers to try seafood in 2020. With seafood consumption generally flat year over year, this opens up an incredible new opportunity for us in the seafood industry. Not to mention that during the pandemic, nearly a quarter of affluent consumers switched from purchasing seafood from restaurants to purchasing seafood to cook from home.

We also know that nearly half (49 percent) of all consumers are trying to increase their consumption of seafood (compared to just 36 percent who are looking to increase their consumption of chicken, 23 percent beef, 17 percent pork, and 23 percent veggie burgers) resulting primarily from seafood’s health attributes and taste. In fact, consumers select seafood (73 percent) and plant-based foods (74 percent) for their healthy appeal. Yet when it comes to flavor, seafood (55 percent) outshines, while plant-based falters (24 percent).

Finding inspiration at the grocery store can help make the sale for seafood. Datassential reports that 85 percent of consumers cite easy and healthy recipe ideas as a motivator for choosing seafood over other proteins, 80 percent say knowing the origin and 78 percent cite sustainability.

Preference for Alaska

There’s so much to Alaska’s story that appeals to consumers: high quality seafood that is wild-caught by generations of dedicated families, fishing boats surrounded by majestic snow-capped mountains, myriad wild species harvested in rugged coastal shores from pristine icy waters. According to the research, Alaska is the most appealing region for seafood at restaurants and grocery stores.

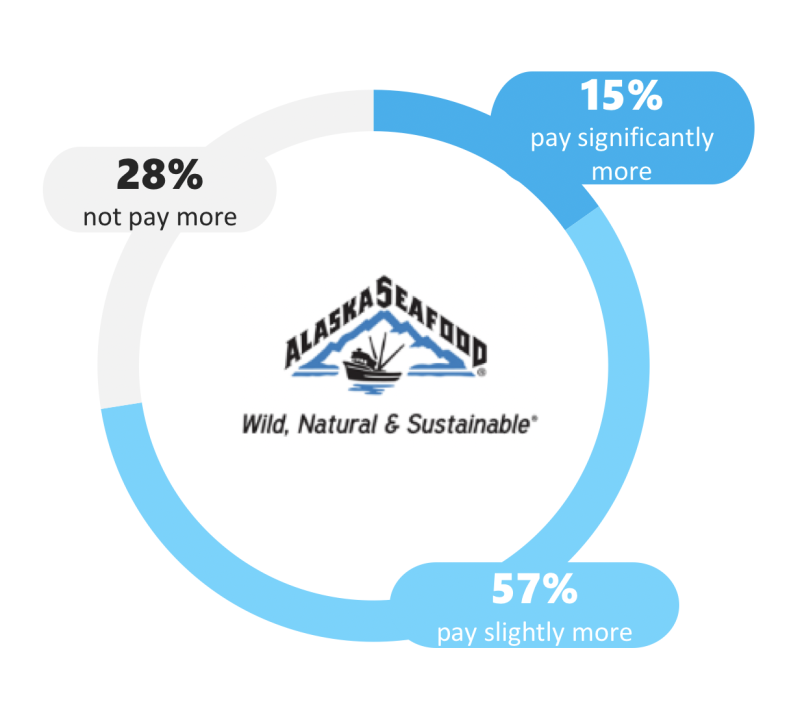

The research shows the preeminence of the Alaska Seafood brand is indisputable. Datassential reports that a whopping 72 percent of general consumers and 77 percent of affluent consumers are more likely to purchase seafood when they see the Alaska Seafood logo. Most consumers say they’ll pay a premium for Alaska’s quality, too, with 72 percent of consumers saying they’d pay more for seafood displaying the Alaska Seafood logo.

Indeed, quality is the centerpiece for the vast majority of seafood shoppers. Most (82 percent) say that if a store carries seafood with the Alaska Seafood logo, they can assume that the retailer cares about the quality of seafood it sells, and 72 percent say they’d recommend buying seafood from that retailer to others. With freshness, taste, and quality as the top three descriptors consumers associate with Alaska Seafood, it comes as no surprise that consumers consider retailers that carry seafood from Alaska the place to go for quality products.

Whether it’s at the market, online or at a restaurant, specifically calling out the Alaska origin in the product name boosts the desirability of many seafood offerings as well. Seven out of 10 consumers prefer Alaska salmon over Atlantic salmon. And with consumers preferring wild seafood 5:2 over farmed seafood, calling out “wild” in combination with “Alaska” increases its appeal even more.

After a year of rapid category growth at retail and looking ahead as consumers slowly head back into restaurants where seafood is historically king, we are optimistic sales of seafood will continue to climb, and that Alaska Seafood will continue to meet consumers’ needs, and exceed their expectations.

Megan Rider is the Domestic Marketing director at the Alaska Seafood Marketing Institute. She lives in Juneau, Alaska.