The theme coming out of Alaska seafood's annual meeting is — no surprise — tariffs.

The Alaska Seafood Marketing Institute opened its All Hands On Deck meeting today in Anchorage with annual updates from its program directors, followed by public meetings for species committees and the Responsible Fisheries Management program.

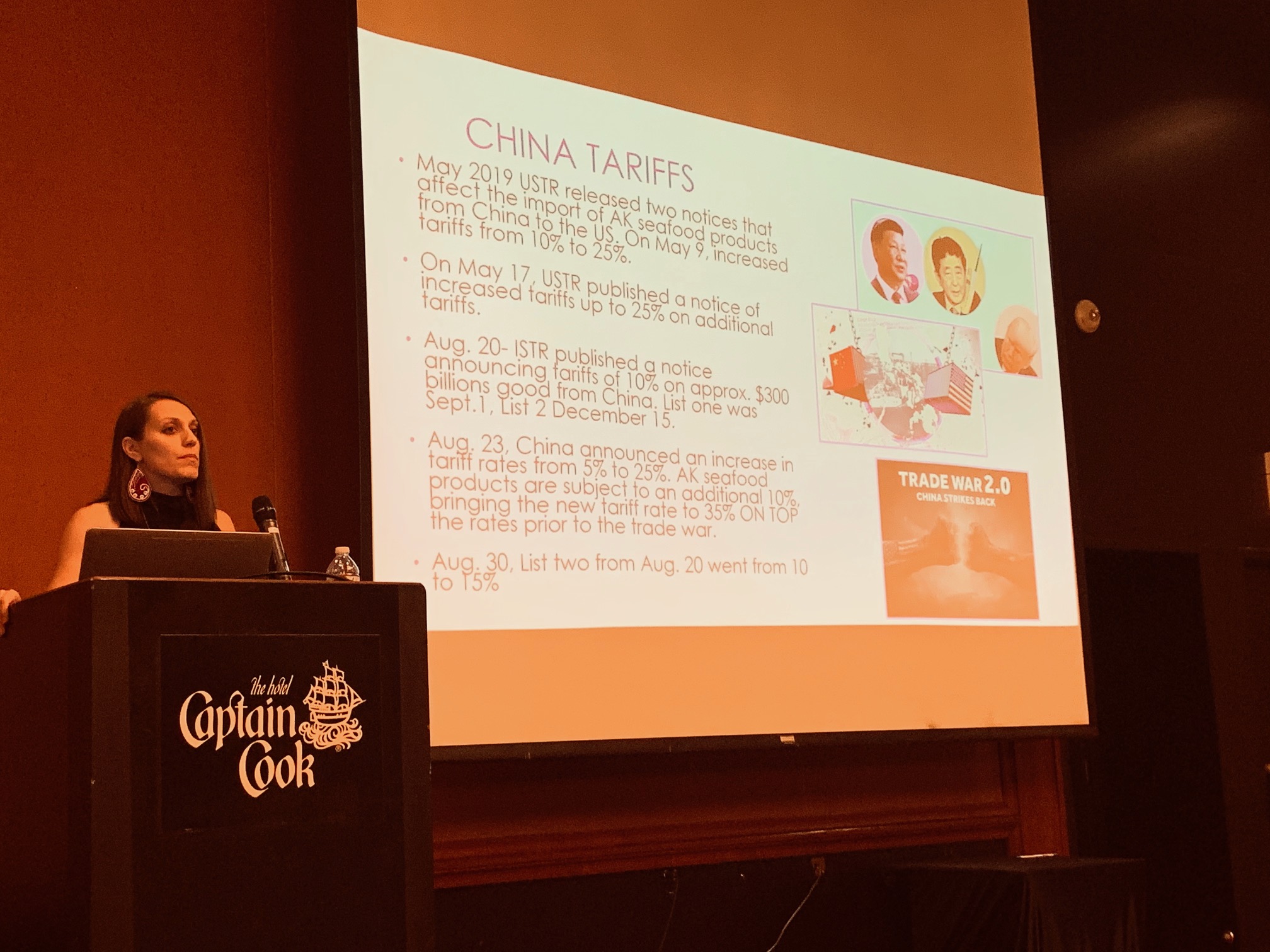

International Program Director Hannah Lindoff opened her update with a slide detailing the current state of U.S./China tariffs.

"This is the most up to date information," said Lindoff. "But if anyone is on Twitter and something changes, please let me know."

Although most products in Alaska's portfolio are exempted from U.S. tariffs on Chinese exports — salmon, pollock and Pacific cod — competition in the global marketplace makes tariffs disadvantageous for any fisheries affected by additional duties.

For example, Alaska contributes 10 to 15 percent of the global supply of red king crab. Russia supplies about 70 percent. Alaska's red king crab quota is down 12 percent for 2020. Golden king crab and snow crab quotas are up 13 and 23 percent, but the tanner/opilio fishery is shut down for the year.

The looming unknown of Brexit is another concern for ASMI's International Program.

"It's not good for commerce," said Lindoff. "We are hoping for the best."

The good news on the international trade front for ASMI is a windfall of nearly $7.5 million in ATP funds from the federal government through the Agricultural Trade Promotion Program, which is part of the USDA. This one-time federal grant program was created to ease pains that resulted from the tariffs for U.S. entities participating in global markets. The funds were established to ease market recovery over the next five years.

"Trade disputes remain an issue," said Garrett Evridge of the McDowell Group. "But we continue to have robust fisheries management, and the brand name of Alaska that continues to resonate."

ASMI's investment in pollock marketing appears to have resulted in a quick payoff with a year-over-year 20 percent value increase in pollock fillets., despite a 15 percent increase in Russia's pollock landings and its advantages in access to Chinese markets.

Prices for farmed salmon are down about 20 percent since 2017, and Russia's harvest of about a billion pounds of salmon last year means competition in this space is strong. And yet, prices and landings for sockeye salmon have exploded in the last couple of years, thanks to investments in quality handling and a Bristol Bay marketing program.